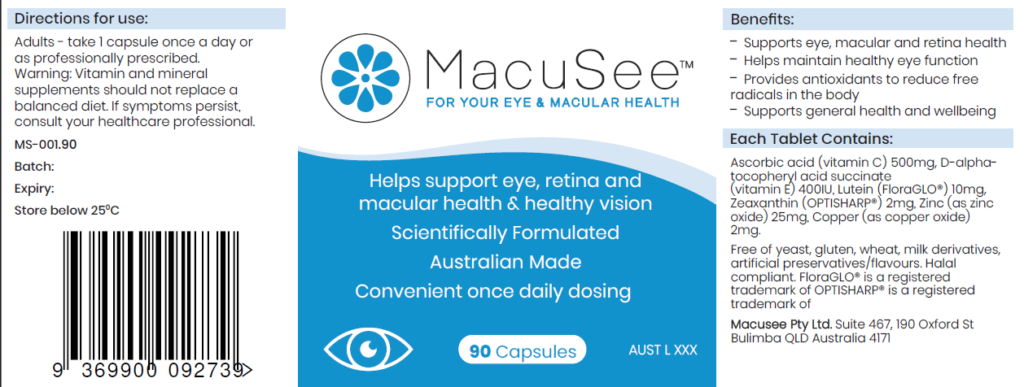

MacuSee had a winning product: an Australian eye health supplement based on AREDS2 formula fighting age related macular degeneration. Evidence based, ophthalmologist recommended, the real deal.

But China was a black box. The market was massive (RMB 440 billion supplement market by 2025) and eye health critically underserved. Only 23% penetration versus 73% in the US. Close that gap to Western levels and you're looking at a $2 billion category opportunity in eye health alone.

The problem? MacuSee had zero China presence, no staff on the ground, and no clue how to navigate cross border e-commerce regulations, find trustworthy distributors, or position a Western supplement brand in a market that operates on completely different rules.

They needed someone who actually knew how this worked. Not theory, practice.

We don't do desk research. We do field intelligence.

While other agencies would have Googled "China supplement market" and called it strategy, we pulled actual sales data from Tmall, JD, and Douyin. Analyzed the top eye health competitors: GMV splits, pricing strategies, promotional calendars, content approaches.

Found the insight that mattered: 70% of Chinese consumers discover eye supplements on Xiaohongshu (RED) before buying on Tmall/JD. That's not in any report. That's platform behavior data.

We built a channel strategy that matched how Chinese consumers actually buy.

Tmall Global + JD Worldwide for core revenue. RED for discovery and credibility. Douyin for engagement with younger demographics. WeChat for retention. Not random. Architected based on consumer journey mapping.

Recommended "Sell Out" model: partner with a CBEC distributor to validate product market fit before committing capital to owned operations. Same economics, fraction of the risk.

We sourced the partner ourselves.

Screened qualified CBEC distributors across the market. Visited operations in Hangzhou, Beijing, Zhejiang. Toured bonded warehouses, met teams, separated PowerPoint promises from actual capabilities.

Facilitated commercial negotiations on wholesale pricing, MOQs, payment terms, exclusivity. Drafted the three party contract defining clear responsibilities between MacuSee, distributor, and us.

Didn't just introduce them and walk away. We stayed in the room until the deal was signed.

Secured CBEC partnership with established eye health distributor. Active presence across Tmall Global, JD Worldwide, with proven regulatory compliance and bonded warehouse infrastructure.

Market ready brand positioning emphasizing AREDS2 science, Australian origin, and "vision longevity" lifestyle messaging. Critical: avoided medical claims that would trigger regulatory issues.

Clear revenue pathway to market with conservative entry strategy designed to capture eye health category share on target platforms.

We remain MacuSee's China commercial team. Monitoring distributor performance, auditing brand compliance, managing marketing strategy, providing strategic guidance. They don't need to hire China staff. We're their team.

That's the difference. We don't consult and disappear. We execute and stay.