What Taobao Instant Commerce Means For Non-Chinese Brands

Double 11 used to be about one question: who could stack the biggest discounts.

This year, Alibaba used it for something different. With Taobao Instant Commerce and the rebrand of Ele.me into Taobao Flash Sale, Alibaba is not just chasing festival GMV. It is trying to retrain how people shop in China every day. Instant delivery is no longer a side product inside a food app. It is being woven into the core Taobao experience.

For non-Chinese brands, this is less about one campaign and more about planning for a world where Chinese ecommerce behaves a lot more like takeaway.

What Alibaba Is Actually Building

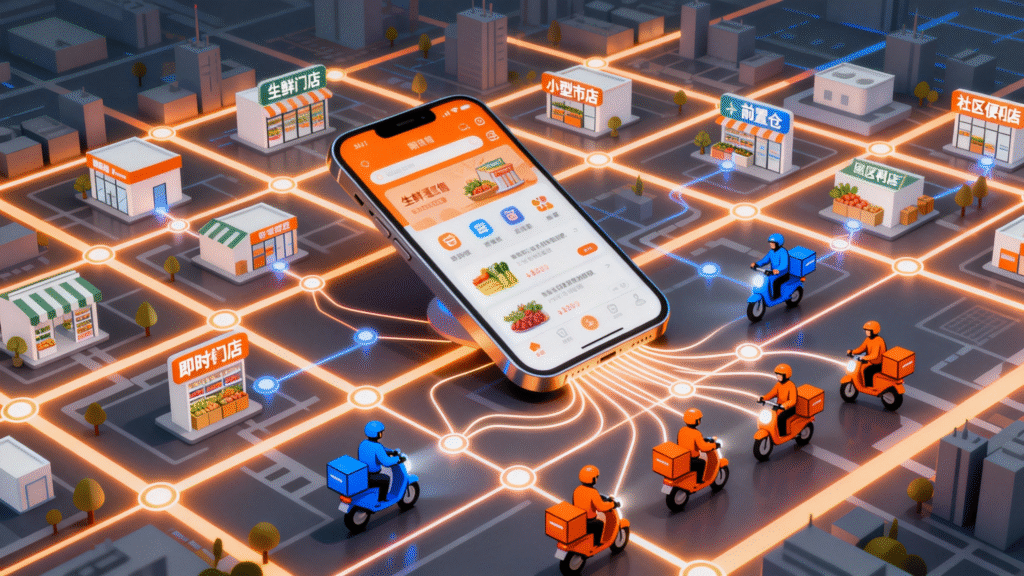

Taobao Instant Commerce upgrades Taobao’s hourly delivery into a single grid powered by Ele.me riders, Freshippo stores, and partner supermarkets. It now covers everyday essentials, some electronics, and fashion, with tens of millions of instant orders a day.

Taobao Flash Sale is the front door for all of this. The Ele.me app is being renamed, riders are recast as city knights, and the familiar blue of food delivery is slowly replaced by Taobao orange.

Underneath, Alibaba has folded real-time retail into its core e-commerce division. Instant commerce is no longer a side project. It is part of Taobao’s main offer.

Heavy subsidies and investment have pushed volumes up quickly while putting pressure on margins across the industry. This is a fight for share and habit, not for neat quarterly profit.

From Shopping Event To Local Life Habits

Traditional e-commerce in China has followed a familiar rhythm.

People browse, compare, park items in carts, and wait for Double 11 or six eighteen to check out. Big orders, a few times a year.

Instant retail runs on different wiring. It is closer to food delivery:

- Immediate need

- Short decision cycles

- High frequency, lower ticket orders

By embedding instant delivery into Taobao and rebranding Ele.me as Taobao Flash Sale, Alibaba is trying to merge these two behaviours. The goal is not just to win Double 11. It is to:

- Create daily touchpoints instead of a few festival spikes

- Lift purchase frequency per user, not only basket size

- Train consumers to expect fast fulfilment for many categories, not only meals

If that shift holds, Double 11 becomes less of a once-a-year explosion and more of a spotlight inside a continuous local life system.

What This Means For Non-Chinese Brands

In the short term, instant commerce wins still skew toward local players in impulse categories with dense store networks. For many international brands, operational and financial barriers remain high.

The strategic direction, however, is already clear:

- Speed is becoming a hygiene in major cities, not a bonus

- Proximity doubles as media, since Taobao surfaces what is nearby and available now

- Platform roles are diverging, with Taobao owning habit and fulfilment, Douyin owning attention and discovery, and JD leaning on logistics trust

How you respond depends on where your brand is today.

Established brands with China store networks

- Treat Double 11 and the following quarter as a diagnostic for speed expectations in your category

- Test a small number of stores as same-day or next-day fulfilment hubs, starting with replenishment-friendly items

- Use pilots to learn how to talk about speed without sliding into pure discount language

Pure e-commerce or cross-border brands

- Accept that building your own instant grid may not yet make economic sense

- Focus on community, story, and distinct positioning on Douyin and Xiaohongshu, where fit and narrative still matter more than speed alone

- Use tactical partnerships with local food or convenience chains during key moments so your products can occasionally ride instant rails without owning them

Emerging premium brands

- Protect perception first: fast should not automatically read as cheap or mass

- Concentrate investment on search and seeding inside Tmall and Taobao, and treat any instant commerce activity as a visibility experiment rather than a volume engine

Planning For An Instant First China

Seen from a distance, Taobao Instant Commerce and Taobao Flash Sale are about logistics, subsidies, and rebrands. Seen up close, they are about something simpler: who defines everyday normal in Chinese retail.

For non-Chinese brands, the shift is clear. You are no longer only competing on who tells the best story at Double 11. You are competing on who feels naturally present in the small, spontaneous decisions that now fill the rest of the calendar.

At BeyondBorderGroup, this is the terrain where we work with clients, connecting global intent to China’s fast-changing local reality. The practical question we come back to is simple.

If China moves from festival first to instant first, which parts of that new journey should carry your brand’s signature, and which parts are you currently leaving for the platforms to decide?