China has emerged as a cashless society, with mobile payments dominating the market. WeChat Pay and Alipay are the primary contenders, each offering unique features and benefits. Understanding their differences can help businesses make informed decisions about which platform to integrate for a seamless customer experience in eCommerce China.

WeChat Pay: Overview and Uses

What is WeChat Pay?

WeChat Pay, a product of Tencent, stands as a cornerstone of China’s mobile payment ecosystem. Integrated seamlessly into the WeChat app, it transforms the platform from a simple messaging app to a multifunctional super app. Launched in August 2013, WeChat Pay has quickly scaled up to cater to over a billion users, revolutionizing how transactions are conducted in China.

Key Features of WeChat Pay

- Integrated Ecosystem: WeChat Pay is not just a payment tool but part of a larger digital ecosystem. Users can perform various activities without leaving the WeChat app, such as ordering food, booking rides, and purchasing products from online stores. This integration simplifies the user experience and fosters high engagement levels.

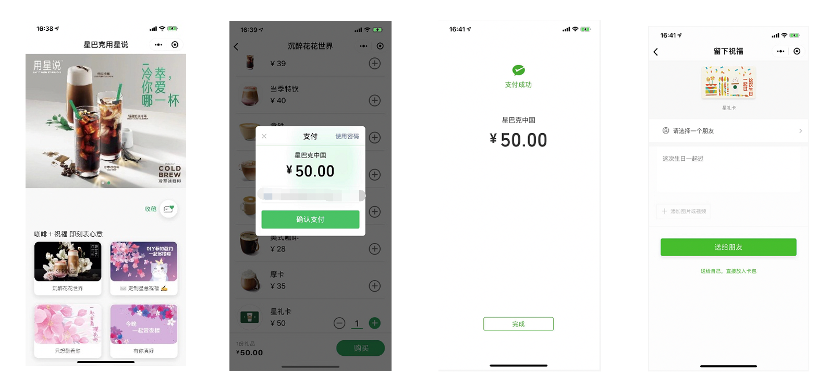

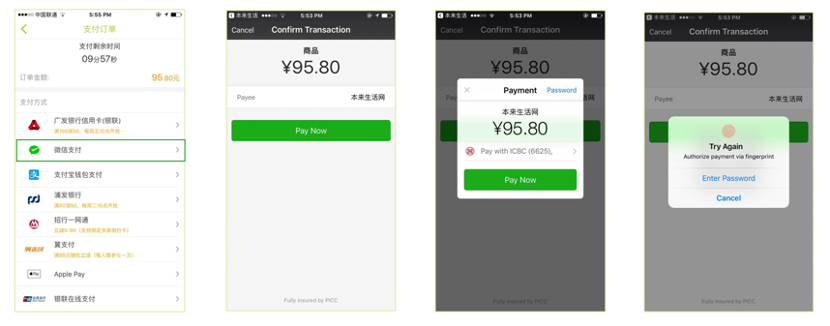

- QR Code Payments: The ubiquity of QR codes in China has made QR code payments a fundamental feature of WeChat Pay. Users can easily scan QR codes at retail outlets, restaurants, and service providers to make payments swiftly and securely.

- Mini Programs: Mini programs are sub-applications within WeChat that provide a range of services without requiring a separate download. These mini-programs allow businesses to set up virtual stores, offer customer service, and run marketing campaigns directly within WeChat, making it easier for users to access services and make purchases.

Setting Up WeChat Pay for Your Business

For businesses aiming to tap into WeChat Pay’s vast user base, setting up an account is a strategic move. Here’s how to get started:

- Create an Official Account: Businesses must first establish an official WeChat account. This requires submitting company information and necessary documentation for verification.

- Choose a Business Profile: Depending on the nature of the business, you can choose between a Subscription account or a Service account. The latter is more suitable for businesses looking to integrate WeChat Pay for e-commerce activities.

- Apply for WeChat Pay: After your account is verified, apply for WeChat Pay through the Official Accounts Platform. Provide details such as expected transaction volumes and bank account information.

- Integrate with E-commerce Platforms: To maximize reach, businesses can partner with major online marketplaces like JD.com, Pinduoduo, VIP Shop, and Kaola. These platforms support WeChat Pay, simplifying the integration process and expanding the potential customer base.

Leveraging WeChat Pay for Business Growth

- In-App Purchases: By integrating WeChat Pay, businesses can facilitate seamless in-app purchases within their WeChat mini-programs. This capability is crucial for driving sales and enhancing user convenience.

- Marketing Campaigns: Businesses can utilize WeChat’s social features to run targeted marketing campaigns. This includes offering exclusive deals and discounts that users can access and redeem directly through WeChat Pay.

- Customer Engagement: The integration of WeChat Pay with social media functions allows businesses to engage with customers more personally. They can interact through messages, offer customer support, and gather feedback, fostering stronger customer relationships.

Alipay: Overview and Uses

What is Alipay?

Alipay, owned by Alibaba, is a pioneer in China’s mobile payment industry. Since its launch in 2004, Alipay has grown to become one of the most widely used payment platforms globally. With over 652.4 million monthly active users, it offers a comprehensive suite of financial services that extend beyond simple transactions.

Key Features of Alipay

- E-commerce Integration: Alipay is deeply embedded within Alibaba’s extensive e-commerce ecosystem, including platforms like Taobao and Tmall. This integration provides a seamless shopping experience for users and a reliable payment solution for merchants.

- Global Reach: Alipay’s services are not confined to China. It is available in over 300 cities worldwide, making it an excellent choice for businesses with an international footprint. This global reach helps businesses cater to Chinese tourists and international users alike.

- Financial Services: Alipay offers a wide range of financial services, including savings accounts, loans, insurance, and investment products. This functionality makes it a comprehensive financial tool for users, appealing to those who seek more than just a payment solution.

Setting Up Alipay for Your Business

To utilize Alipay for business, follow these steps:

- Create a Merchant Profile: Begin by setting up a merchant profile using your existing Alipay account. This process involves submitting detailed company information and financial documentation for verification.

2. Integrate the Payment Gateway: Once verified, integrate Alipay’s payment gateway into your business operations. For physical stores, this typically involves setting up QR code payments. For online businesses, integrate Alipay into your checkout page or partner with third-party platforms that support Alipay.

3. Utilize Financial Tools: Alipay provides various tools for financial management, such as detailed reporting and analytics. These tools offer insights into sales patterns, customer behavior, and transaction histories, helping businesses make data-driven decisions.

Leveraging Alipay for Business Growth

- Enhanced Customer Experience: Alipay’s efficient transaction system ensures real-time payment confirmations, enhancing customer satisfaction. This immediate feedback loop is critical for maintaining a positive customer experience.

- Financial Management: Alipay’s financial tools allow businesses to track sales, manage refunds, and analyze customer payment behaviors. These insights are invaluable for strategic planning and optimizing business operations.

- Marketing Opportunities: Businesses can utilize Alipay’s platform for targeted advertising and promotional campaigns. This includes offering discounts, loyalty programs, and special deals to Alipay users, driving traffic and sales.

WeChat Pay vs. Alipay: Key Differences

Social Media and E-Commerce Integration

WeChat Pay excels in integrating social media with e-commerce. Its mini-programs allow businesses to engage with users within the social platform, making transactions more interactive. In contrast, Alipay focuses more on e-commerce with robust support for Alibaba’s platforms.

User Experience

Both platforms offer a user-friendly experience, but WeChat Pay’s integration with WeChat makes it particularly appealing for younger users who value social interaction. Alipay’s strength lies in its financial ecosystem, catering to users who seek comprehensive financial services.

Market Reach and Demographics

WeChat Pay and Alipay both have extensive user bases. WeChat Pay’s social media integration makes it popular among younger demographics, while Alipay attracts a broader age range with its financial services.

International Payments

Both platforms support international payments, but WeChat Pay’s integration with social media offers unique opportunities for marketing to Chinese tourists abroad. Alipay, with its global reach and ties to Alibaba, is ideal for businesses focusing on e-commerce and financial services.

Choosing the Right Platform for Your Business

When deciding between WeChat Pay and Alipay, consider your business goals and target audience. If your strategy involves social engagement and leveraging China’s most popular social media platform, WeChat Pay is the way to go. It allows for seamless integration of commerce within a social context, enhancing customer retention and engagement.

On the other hand, if your business model is centered around e-commerce and financial services, Alipay offers a robust ecosystem that can support various financial needs and provide detailed insights into customer payment behaviors.

In conclusion, both WeChat Pay and Alipay offer distinct advantages for businesses looking to tap into China’s vast mobile payment market. By understanding their unique features and aligning them with your business goals, you can choose the platform that best suits your needs and enhances your customer’s experience in eCommerce China.